r&d tax credit calculation example

We can then subtract the 5000 shares repurchased from the 10000 new securities created to arrive at 5000 shares as the net dilution ie the number of new shares post-repurchase. For SMEs claiming RD tax credits the accounting treatment is straightforward.

The Amt And The Minimum Tax Credit Strategic Finance

This taxpayer must file a Form 3115 to adopt the default Sec.

. The average credit card interest rate was 1617 in February 2022. It is a below-the-line benefit and will be shown in your income statement also known as your profit-and-loss account either as a Corporation Tax reduction or a credit. Accounting treatment for SME RD tax credit scheme.

The calculation of the capped credit for RD workers PAYE and NIC is set out at CIRD89790 and CIRD89800. Wage expenses utilized in the ERC calculation cannot also be used in the RD Credit calculation. Basic SRED investment tax credit rate 15.

Happys RD tax credit adviser investigates the eligibility of the labour costs for RD tax credits whilst Happys accountant prepares the company tax return and capital allowances calculation. Due to it being simple to understand it is often called an alternative simplified credit. Before April 1 2015 and after March 31 2012 the Saskatchewan tax credit was refundable for CCPCs subject to a 3 million expenditure limit and non-refundable in all other.

You can expect to pay a few more points for store credit cards. The RD tax credit is an example of a carryforward credit. Minnesota Department of Revenue Individual Income Tax.

A one-to-one ratio of reduced tax revenue to induced investment is thought to represent a meaningful effectiveness threshold based on the assumptions that. 1 a 1 increase in investment in response to a 1 tax credit suggests that the tax credit may be more cost-effective than a well-structured direct RD subsidy and 2 due to the potential. Mail your property tax refund return to.

While some taxpayers with simple returns can complete their entire tax return on this single form in most cases various other additional. Companies defined as established firms are firms with gross receipts and QREs in at least three of the tax years from 1984 to 1988. 471 method for its 2019 tax year.

Beginning in 2026 adjusted regular tax liability is reducible by all credits. As a result equipment and other plant totalling 100000 is allocated to the AIA and deducted in full. Treasury Stock Method Calculation of Diluted Shares.

Minnesota Department of Revenue Mail Station 0020 600 N. Like the Federal Form 1040 states each provide a core tax return form on which most high-level income and tax calculations are performed. Tax treatment is covered under Income Tax Act clause 1010ii wherein gratuity payment under the 1972 Act is exempt from calculation of previous years income.

The company has the option of following the path in Example 1 or adopting the alternative Sec. Form D-40 is a District of Columbia Individual Income Tax form. Minnesota Department of Revenue Mail Station 5510 600 N.

IRS publication 535 which covers business expenses allows companies to use straight-line amortization of goodwill over a period of 180 months for tax purposes whereas they must use the impairment of value measure to determine any amortization loss for book purposes. Paul MN 55146-5510 Street address for deliveries. Same as Example 1 except the company has audited financial statements.

Thus there is a tax savings referred to as the tax shield. For the other corporations the Saskatchewan RD tax credit remains a non-refundable tax credit at the rate of 10 on eligible expenditures incurred after March 31 2015. Therefore why cant Tax Guru take a clear cut stand on this and why the PSU managements who deducted tax at source give the benefit of tax exemption in Form 16 to file refund.

Net Income Formula Example 5. The basic rate of an SRED investment tax credit ITC is 15 for tax years that end after 2013 and 20 for tax years that end before 2014For tax years that include. Generally businesses can claim RD tax credits for tax returns with an open statute of limitations which typically includes the prior three years.

Your RD tax credit is not taxable income. The amount which exceeds the cap is carried forward and added to any expenditure credit. Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax.

If a company has zero debt and EBT of 1 million with a tax rate of 30 their taxes payable will be 300000. Business and student credit cards will help you minimize your interest rate. Paul MN 55145-0020 Mail your tax questions to.

For instance lets say that a company has 100000 common shares outstanding and 200000 in net income in the last twelve months. For example software companies that invest in their technology. Wage expenses that qualify as both ERC-eligible Qualifying Wages and Qualified Research Expenses for RD Credit purposes still need to be included as QREs in the base year calculations for future year RD Credit calculations.

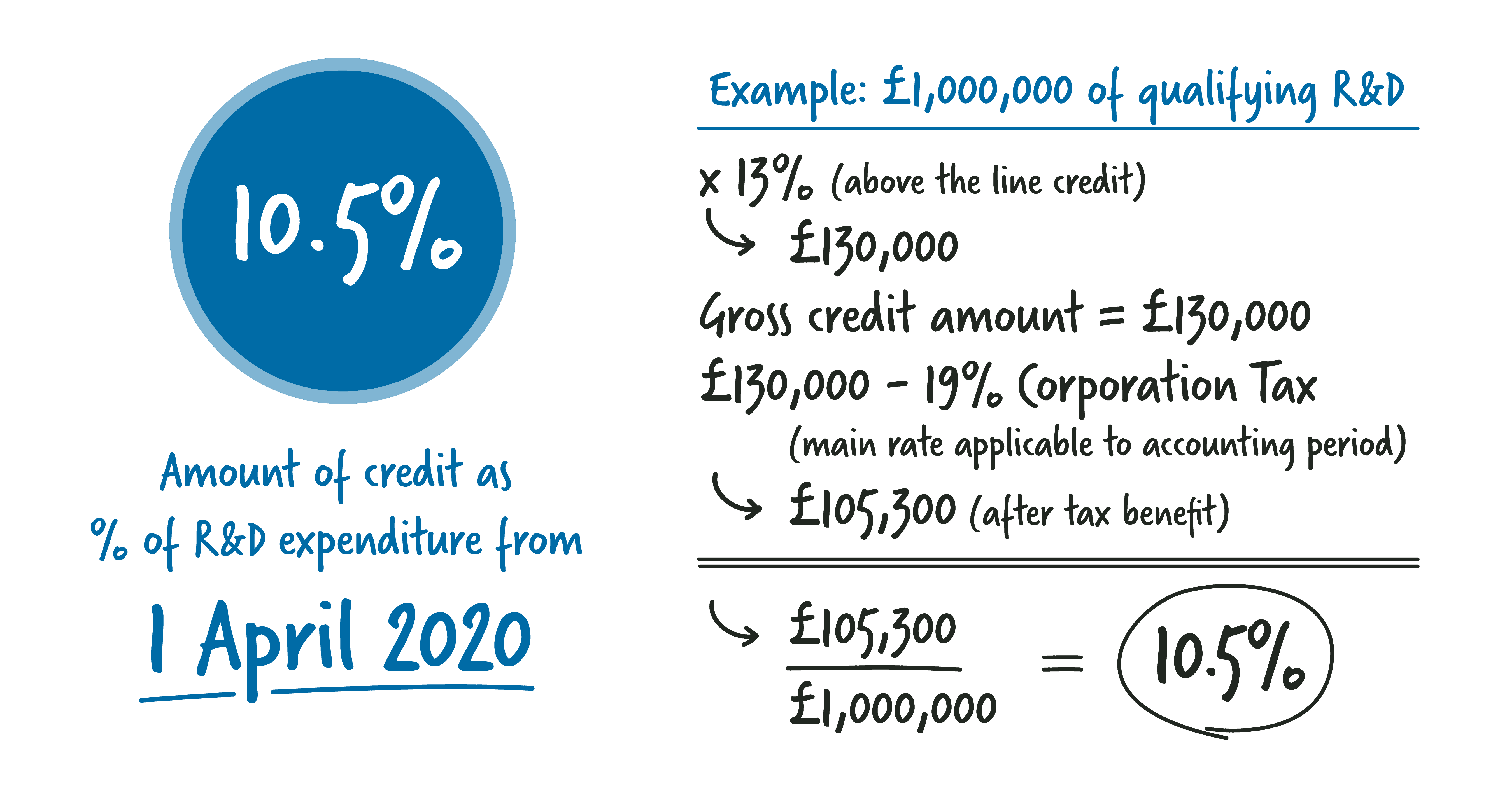

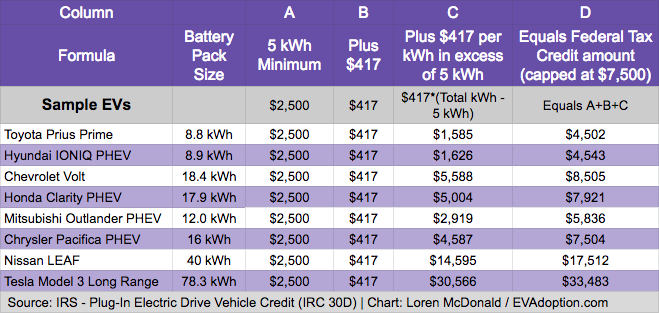

Income tax deductibility tax shield Interest is a reduction to net income on the income statement and is tax-deductible for income tax purposes. RD Tax Credit Calculation. The regular RD credit equals 20 percent of a firms QREs above a certain baseline level.

How far back can you claim RD tax credits. Until 2025 the adjusted regular tax liability is reduced by the RD tax credit a portion of the low-income housing credit the renewable energy production credit and the energy investment credit. Ltd for the year 2018 and 2017.

Taxes are generally an involuntary fee levied on individuals or corporations that is enforced by a government entity whether local regional or national in order to finance government activities. These tools help to track business transaction and calculation of financial ratios. Basic research is work undertaken for the advancement of scientific knowledge without a specific practical application in view.

Lets see an income statement of a printing company named Arts Printer Pvt.

R D Tax Credit Rates For Rdec Scheme Forrestbrown

Standard Deduction Tax Exemption And Deduction Taxact Blog

R D Tax Credit Calculation Methods Adp

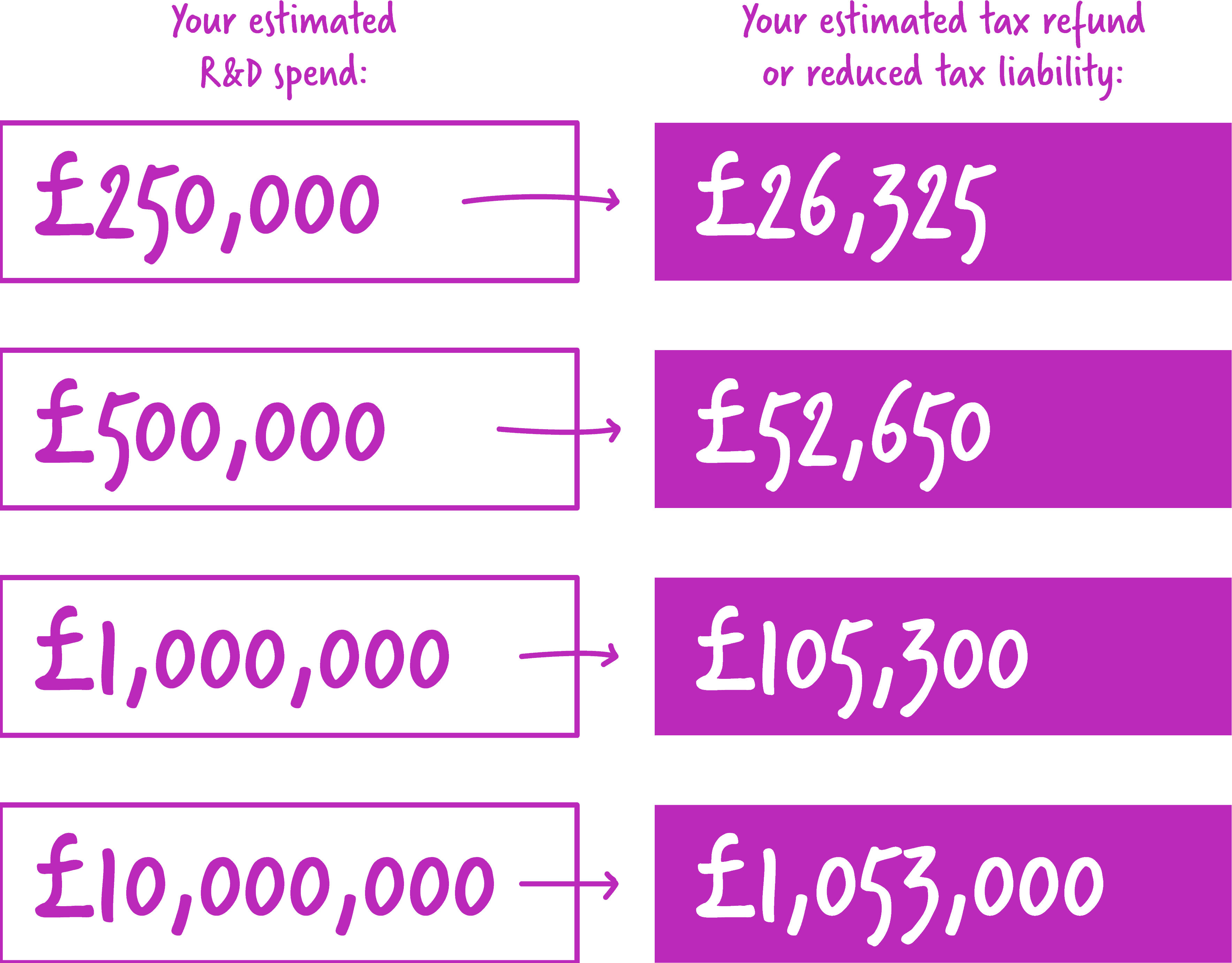

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Examples Mpa

Interest Tax Shield Formula And Calculator Excel Template

R D Tax Credit Calculation Examples Mpa

Demystifying Irc Section 965 Math The Cpa Journal

Capital Expenditure Report Template 1 Professional Templates Budget Template Free Budget Template Excel Budget Template

R D Tax Credit Calculation Methods Adp

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Demystifying Irc Section 965 Math The Cpa Journal

R D Tax Credit Calculation Adp

Demystifying Irc Section 965 Math The Cpa Journal

R D Tax Credit Calculation Adp

The Amt And The Minimum Tax Credit Strategic Finance

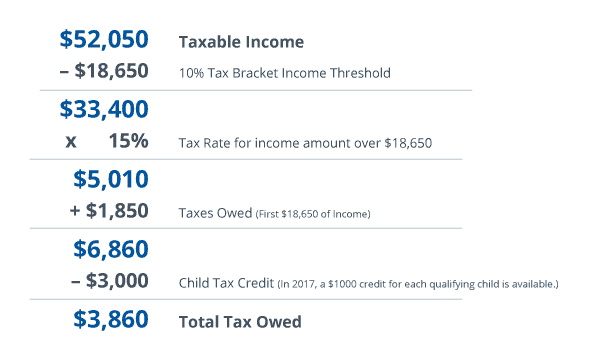

How Is Tax Liability Calculated Common Tax Questions Answered

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)